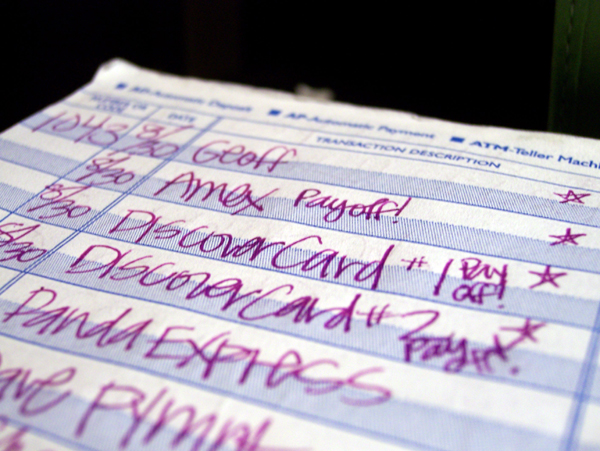

Photo by lemonjenny

Keep Balances Down

When a potential creditor looks at your credit history, they want to see that you actively use your credit. This shows you are capable of making timely payments and being responsible with the credit you have. With that being said, you should only use about 30% or less of the credit you have available to you.

When it comes to credit cards, it’s a good idea to carry a balance as long as that balance doesn’t exceed 30%. This may seem like a tight rule to follow, but when you follow it for long enough and make timely payments, your credit limit will eventually be raised by the credit card company. It won’t take you long before your current 30% limit is the same amount as your original total available limit.

|